Stock Market Crash – How you gain from it (No not just the opportunity to buy at lower price)

This week saw deep corrections in the stock markets the work over. There was no dearth of gurus talking about the stock market crash, most of them flatly blaming the Chinese for it.

This week, in the note to the subscribers of my blog, I mentioned that this is not the time to panic, instead use this opportunity to buy good companies in small quantities.

Also Read:

2nd Nov 2014 – Time to Book Profit? (NIFTY 8325)

23rd March 2015 – The Bull Market is Aging, Here’s What You Should Do (8550)

Today, let’s see what we can learn and what the market teaches us during market crashes.

Lesson 1: Opportunity to buy at a lower price

Like I wrote in my note, “Sit tight, and buy small quantities of high quality stocks. If a company looked good at 100, and is now available at 90, buy a few shares.”

But in order to take advantage of the fire sale, an investor has to be ready with his wish list. Figuring out what to buy at that time is like digging a well when you are thirsty.

Lesson 2: Validates your conviction to stock investing

It is during such market crash that your conviction to stock investing is validated. When you see your stock portfolio take a 5-10% dive in a single day, it is gut wrenching. This is one such asset class where you can easily see the price movements and its impact on the portfolio so easily. Besides, this is also one of the most liquid asset classes. Hence it is very tempting to liquidate a part of the stock portfolio during market downturns.

You can thank the stock market crashes for helping you vindicate your belief in stocks.

Lesson 3: Validates your stock selection

It is during these market downturns that the market truly tests your stock selection. If you have done your homework, and identified great companies, your portfolio will be able to weather the storm. During a bull run, even the laggards do well, however, during uncertain times, good companies hold up better.

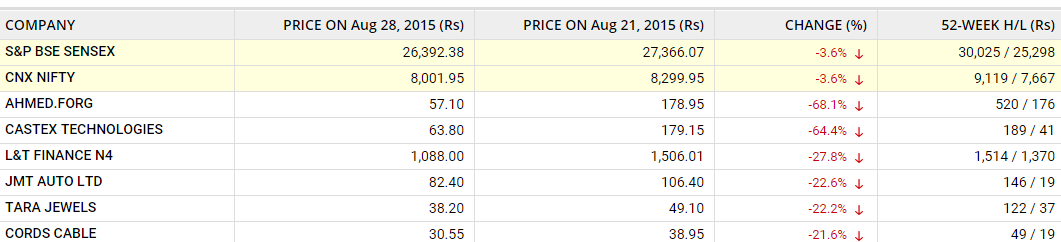

The screenshot below shows the companies on NSE that lost the most in the last week. L&T Finance N4 (Bond) may have paid a dividend and hence it is on the list. But that apart, how many are household names?

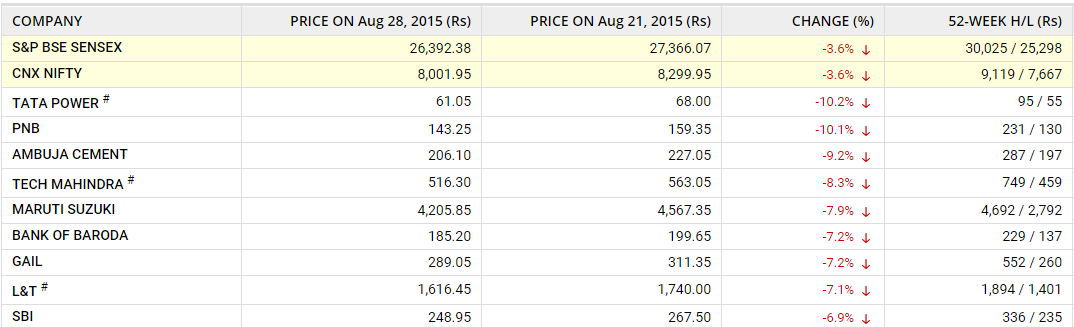

The screenshot below shows the NIFTY 50 stocks that lost the most in the last week. Tata Power lost 10% compared to Ahmed Forging’s whopping 68%!

The screenshot below shows the NIFTY 50 stocks that lost the least in the last week. Ultratech Cement lost less than 1%.

Now compare these names with the ones in the first figure. These are all large cap companies.

Source: https://www.equitymaster.com/stockquotes/mkt-stats/result.asp?type=9&group=14&limit=50

In your portfolio you must have not only fast growing small and mid-cap companies, but you should also have large cap names to give your portfolio stability during stock market crashes. Many of these large caps still grow at over 15% and provide excellent returns.

Lesson 4: Teaches you to take the emotion out of investing

This is by far the most important lesson the market will teach you during market downturns. It will teach you to not be afraid of losing money. If you can learn to take fear and greed out of the equation, you will do well. Again, it is only during a downturn when you will know if you let fear drive your investment decisions or not.

Most of us are net buyers in the stock market, unless you are close to retiring or already retired. Most of us will buy more equity than what we sell over the years. We will retire with a pile of equity. There is a long way to build up that pile. Hence it would be prudent to keep making small additional investments when the markets go down – the key is, identifying stocks that will give you great returns.

In my book, ‘Stock Picking Made Easy’, you will find a simple strategy to identify great companies at reasonable valuations in the Indian Stock Exchange. Identifying great companies at the right time is the key to long term wealth creation.