Time to Book Profit?

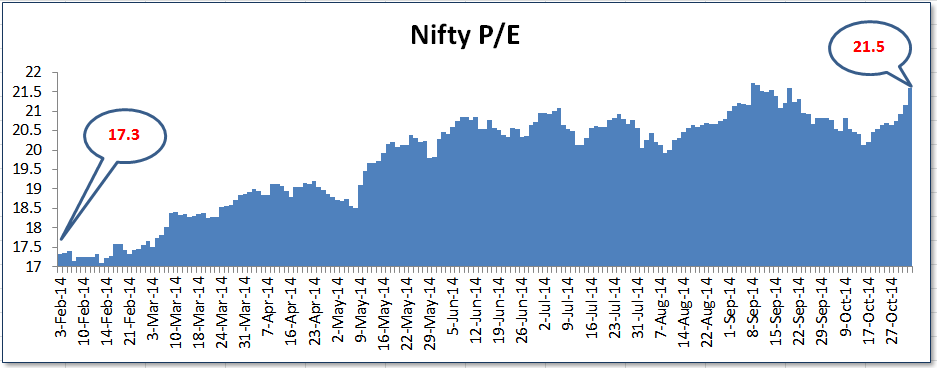

After yesterday’s 400 point rally, and NIFTY at an all time high, it is prudent to take a step back before investing new money.

Major newspapers and popular investing websites are screaming “Buy! Buy! Buy!”. Retail investors are rushing like there’s no tomorrow. Mutual funds inflow hit an all time high recently. Foreign institutional investors are pouring in 100’s of crores every day.

In this euphoria, let’s take a step back and analyse the situation.

If you are new to investing, let’s take a quick look at the P/E ratio. It is simply the price of 1 share divided by the net earnings of the company per share. In other words, if the net profit of a company per share per year is Rs. 2, and the price of one share of the company is Rs. 20, the PE or P/E ratio of the company is 20/2 = 10. This means, we the investors are willing to pay Rs. 10 for each Rs. 1 of net profit.

If we extend this definition to NIFTY, the PE of NIFTY is sum total value of all NIFTY companies divided by the total profit of all NIFTY companies. Since the NIFTY PE is an average across 50 companies, it typically stays in a very narrow range. Not all companies do great at the same time nor all companies perform poorly at the same time, right?

If P/E is 15, it means Nifty is 15 times its earnings. Nifty is considered to be in oversold range when Nifty PE value is below 14 and it’s considered to be in overvalued range when Nifty PE is near or above 22.

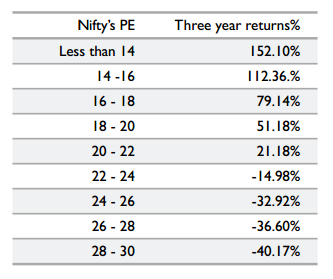

Check out what Professor Bakshi (a famous Indian value investor ) has to say about Nifty P/E. “Recent research done by my firm shows just how dangerous it is to remain invested in an expensive market. Since NSE started, every time when Nifty’s Price/Earnings ratio exceeded 22, the average return from Indian equities over the subsequent three years became negative.”

History clearly tells us that if you are a passive long term investor you should buy stocks when P/E reaches 15-16 and stop buying when P/E goes above 22. We are very close to the PE of 22.

It would be prudent to book some profit once NIFTY PE crosses above 20. PE crossing above 20 does not mean markets has to fall , it’s only an indication that markets may be oversold and now “smart people” will starting selling their shares to mad public .

Also Read – Stock Market Crash – How You Gain From It.