RBS said “sell everything” on Jan 11 2016 – What if you had followed their advice?

On January 11, 2016, Royal Bank of Scotland (RBS) bombarded the news media, advising investors to ‘Sell Everything’.

You can read the article here and here.

Their reasons were:

- Bearish China

- Bearish global commodities (hards, softs, fluids). And more specifically . . .

- Bearish oil (target $26, then clear risk of $16)

- CBs (mostly everywhere) will ease more

- The world has far too much debt to be able to grow well – global output

gap widens - Emerging market majors (outside India & Eastern Europe) all remain sells

- Automation on its way to destroy 30-50% of all jobs in developed world

- Currency war / mercantilism

- Global disinflation risks turning into global deflation in 2016

- Everyone thinks ‘goldilocks’. We thought this strongly for >2 years (on our liquidity theme) but now worry about equities/credit, both huge, multi-year, well held positions. Negative returns in 2016 are probable, though without a recession they should be manageable, think -10-20%, rather than a rout

- If we see weaker ‘risk on’ products, the last safe ‘high yielder’ is the EMU periphery. Our new 0.75% 10y BTP target could prove too high a yield

- Risks to 0.16% new 10y bund target are on the downside, not upside

- Main risk comes from oil. A plunge sub $20 would aid consumption

The report says, Andrew Roberts, and the interest rate strategy team at RBS, has advised clients to, “Sell everything except high-quality bonds.”.

Let’s see how the next 6 months panned out…

S&P 500 returned 9% from then to now.

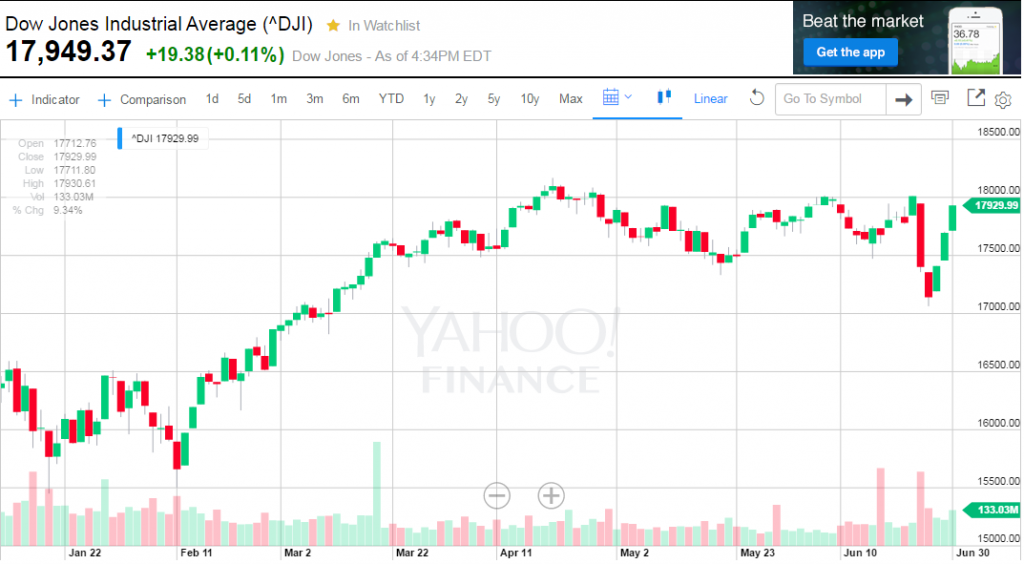

Dow Jones Industrial Averaged also returned 9%

Nasdaq Composite returned 4.4%

Gold (GLD) returned a whopping 20%

Even Crude oil returned a nice 31%

Compared to this, RBS lost a huge 38% during the same period.

So much for “Sell Everything”. They might have meant “Sell RBS” instead.

This is yet another data point of how retail investors get sucked in by such crazy reports.

The only way, you and me, retail investors can make money in the stock market is by focusing on value, and staying invested in quality stocks.

The key is, stay invested in solid companies, and keep buying when an opportunity presents itself. I believe, such opportunities will be plentiful this year, however they will not last long. If you are not ready to purchase, you will lose the opportunity.

My value averaging portfolio has not only recovered the losses, but now gives an annualised return 8.7% (up from 7% last week). You can read all about my ‘Value Averaging’ portfolio here.

Sign up to receive a detailed weekly update on the portfolio.

SPECIAL OFFER: 30% discount on the regular price of Rs. 65/week (Rs.3380/year). Save Rs. 1014 with a one-time only 30% discount. It is completely risk free. You can cancel at any time.

Happy Investing!