Everything you ever wanted to know about Momentum investing

Momentum investing typically works well in a long bull or a bear market. The basic premise is, stocks that are going up, will continue to go up. Ones that are going down, will continue to go down.

What is Momentum Investing?

Momentum investing is a strategy that aims to capitalize on the continuance of existing trends in the market.

The momentum investor believes that large increases in the price of a stock will be followed by additional gains and vice versa for declining values. In other words, when the stock market is going up, it will continue to go up, until it doesn’t.

This strategy looks to capture gains by riding “hot” stocks and selling “cold” ones. A momentum investor is actually a trader who takes a long position in a stock, that has shown an upward trending price, or short sells a stock that has been in a downtrend. The basic idea is that once a trend is established, it is more likely to continue in that direction than to move against the trend.

Stock momentum has nothing to do with the fundamentals of a company, and much more to do with the human propensity to extrapolate the flimsiest trends into the future. It feels wrong that money can be made this way. Momentum investing is prone to serious setbacks on those occasions when the momentum snaps back and reverses.

Analysis of Hulbert Financial Digest’s database of momentum investment advisors’ showed the following in their portfolios. They reflect a wide variety of strategies for reducing the volatility and risk otherwise associated with momentum—everything from market timing, sector rotation, options and a focus on momentum over shorter periods than the last 12 months.

Several interesting themes emerge from the analysis:

- Perhaps most crucially, that the momentum strategies these advisors devised have struggled. None of the five has beaten the market over the past five years, and only one did so over 10 years. Over the past 15 years, however, three have beaten the market—suggesting that a key part of making money from momentum is sticking with it over the long term.

- Another crucial theme is that the strategies these advisors pursued were only partially successful in reducing the volatility and risk otherwise associated with momentum.

- Coupling momentum with market timing is not a panacea. This might be a surprise, since such a coupling, at least theoretically, should allow investors to participate in momentum’s bull market gains while immunizing them from its bear-market losses. But the two model portfolios that have tried their hand at such a coupling lagged the market over five and 10 years, and only one of the two has beaten it over the past 15 years.

- Also not a panacea is trying to capture momentum through the options market.

- Momentum’s cycles may have become shorter than the 12 months on which academics tend to focus. Note carefully, however, that even the best-performing momentum strategy has been just as volatile as the overall market.

Improving the Momentum Strategy with Value

So far, your impression would be to think that value and momentum are polar opposites. You would be correct, but what happens if you innovate and marry them together? They work remarkably well together. Think of the combination as cheap stocks that the market is just beginning to notice. The combination of the two factors yields results more impressive than either of the two investing styles on their own.

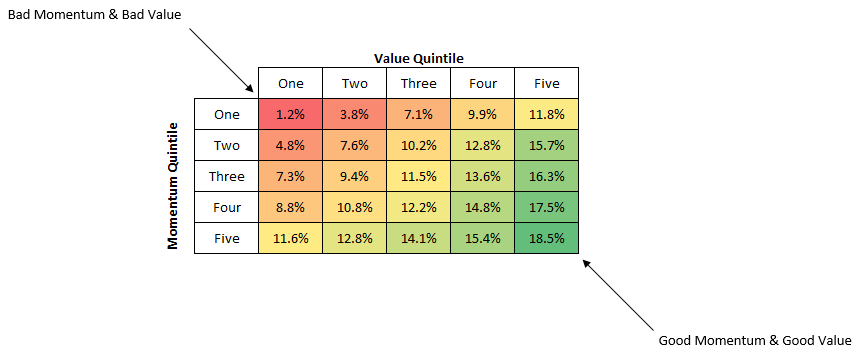

In the American stock market, the cheapest 10% of stocks by P/E have historically delivered 16.3% per year, and the top momentum stocks have delivered 14.4%, but a combination of the two has yielded 18.5% per year (bottom right corner of the table below). What’s more, the volatility of this combined strategy comes way down: from 24.4% for raw momentum to 18.9% for value + momentum.

Quality Works Too

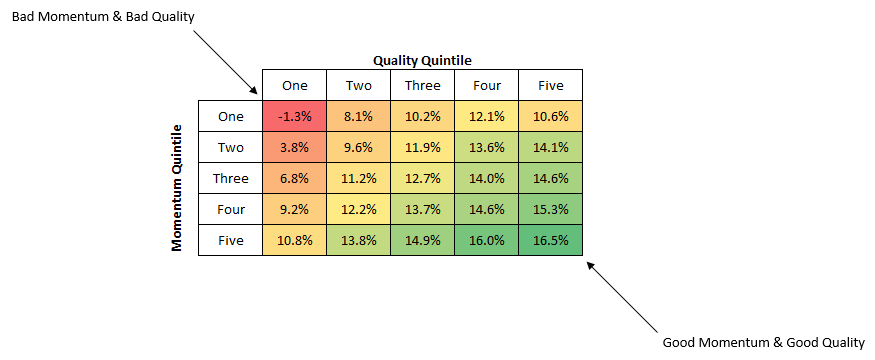

A second way to improve the momentum strategy is to focus on companies with higher quality earnings. The simplest way to define quality earnings is by looking at non-cash earnings. The fewer non-cash earnings (which come from accruals like accounts receivable), the better. Here is a similar 5×5 panel by quality and momentum. The effect is similar to value, but quality is a different factor and so a different take on qualifying the stocks you are willing to buy.

In my book, ‘Stock Picking Made Easy’, you will find a simple strategy to identify great companies at reasonable valuations in the Indian Stock Exchange. Identifying great companies at the right time is the key to long term wealth creation.

Note: The Hulbert Financial Digest is an independent, impartial and authoritative rating service that arms you with the facts about stock and mutual fund investment letter performance. Mark Hulbert started this newsletter to help investors choose investment newsletters, based on proven performance, instead of unproven claims.