Value Averaging Portfolio – Weekly Update

Month End Update – September 2015

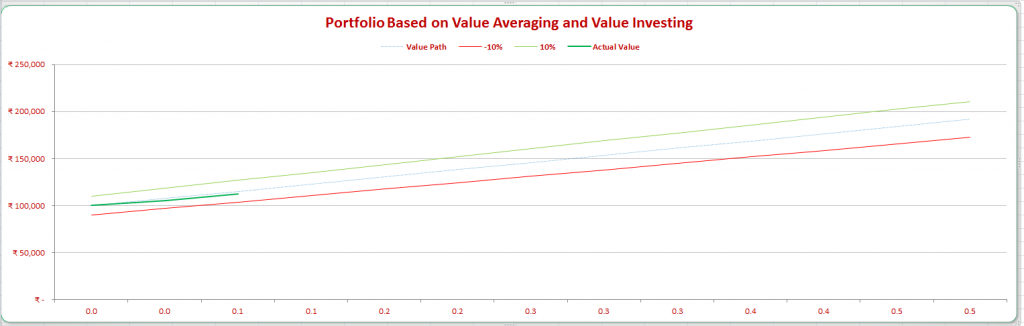

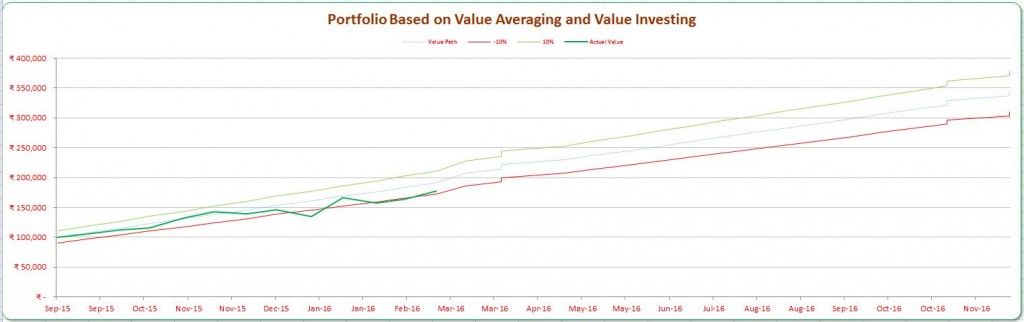

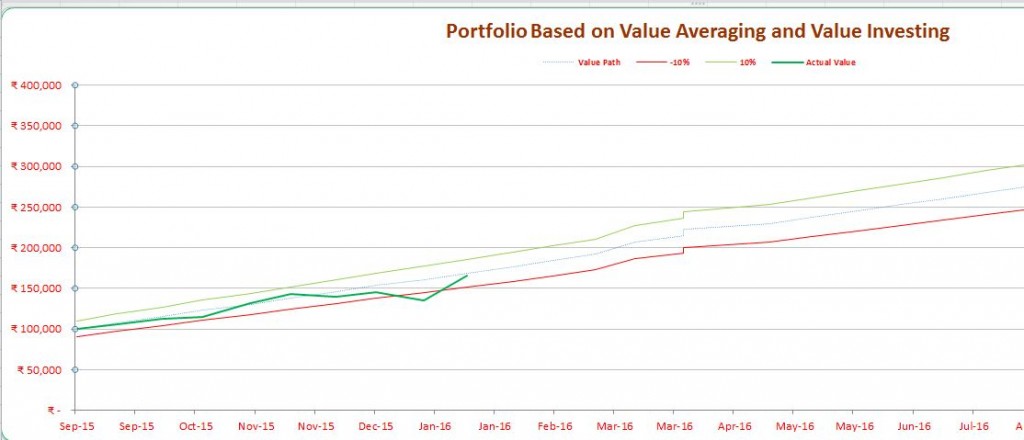

The portfolio value at the end of this week should be higher than 96,875 and less than 118,403. The actual value of the portfolio is 105,663. The portfolio consists of all large cap companies. The current holdings are HDFC, HDFC Bank and TCS. All of them are currently in green. The PE of all the three companies is below 25.

The reserve bank of India (RBI) reduced the interest rate by 50 basis points. Yet, the market didn’t really go up. Reduction of 25 basis point was already factored in by the market, but 50 was surely a surprise, and yet, the performance was lacklustre.

The market ignored a huge positive surprise. This is sign that this is no more a bull market. Unless something changes fundamentally, at best, I expect the market to go sideways or slowly drag lower. NIFTY PE is 22.21. I would like to see It around 20. For that to happen, either the earnings must increase or the price should go down or both.

Let’s see what the next week brings…

More on this real life experiment

More on Value Averaging

Mid October 2015 (10th October 2015)

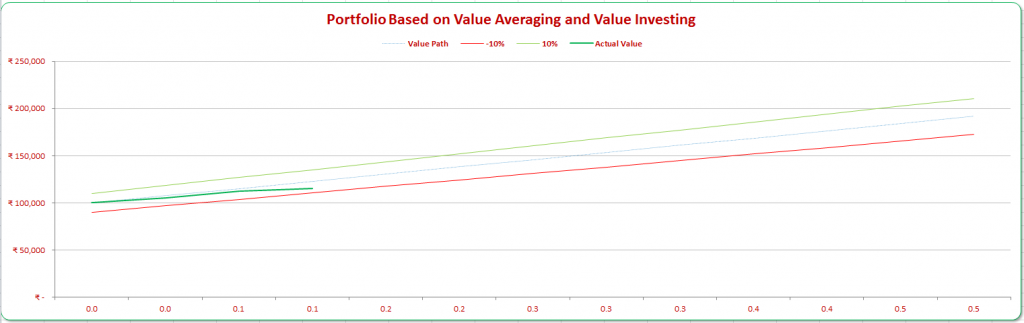

I haven’t added any new investment since starting this portfolio. The current value of the portfolio is up to Rs. 112,373, a gain of 9.3%. According to the Value Path, it should be 115,278. The 10% range is 103,750 and 126,806. The portfolio is just Rs. 2900 off from the Value Path. At the end of the first week of October, the portfolio was off by Rs. 2000.

Remember, we have to invest the amount required so that the value of the portfolio is as expected on the Value Path. Since the portfolio has performed well, the expected new investment is only Rs. 2000.

There has been no fundamental shift in either the Indian economy or the companies we own – HDFC, HDFC Bank and TCS. TCS will announce the quarterly result in the next few days.

The PE of NIFTY has moved to 22.88 from 22.21. PE of HDFC is 22.39, HDFC Bank is 26.66 and TCS is 22.8. None of these companies are really cheap at their valuation. The reason to have them on our portfolio is – they have delivered consistent performance over a long period of time. Besides, they have a very “clean” management.

Technically, it looks like banks like HDFC Bank, SBI etc. may come down in the coming days. I watching stocks like Ipca and Vinati Organics to purchase to purchase at the right price.

End of October 2015 (25th October 2015)

I haven’t added any new investment since starting this portfolio. The current value of the portfolio is up to Rs. 115,129, a gain of 12.08%. According to the Value Path, the portfolio should be 122917,278. The 10% range is 110,625 and 135,208. New investment required is Rs. 7788 to get back to the ideal Value Path.

Remember, we have to invest the amount required so that the value of the portfolio is as expected on the Value Path. Since the portfolio has performed well, the expected new investment is only Rs. 7788 instead of Rs. 7639 * 4 periods = 30,556. Since all stocks that I would like to buy are expensive, I will put this amount into a money market account. The plan is to keep building up the cash war chest while the market is doing good.

I will use the cash to buy equity when the valuations are more reasonable. Some companies I would like to buy are Amara Raja Battery, Vinati Organics, Ipca Labs, TCS, and a few others. But all of these are trading at valuations that I am not very comfortable with. Besides, the next week is F&O expiry and it is safe to assume volatility. Technically, I feel banking should react (thought that last week too, but it didn’t happen). However, last week, EU decided to reduce interest rate and may announce another QE. This can fuel a short term rally. I am patiently waiting on the sidelines.

Mid November 2015 (8th October 2015)

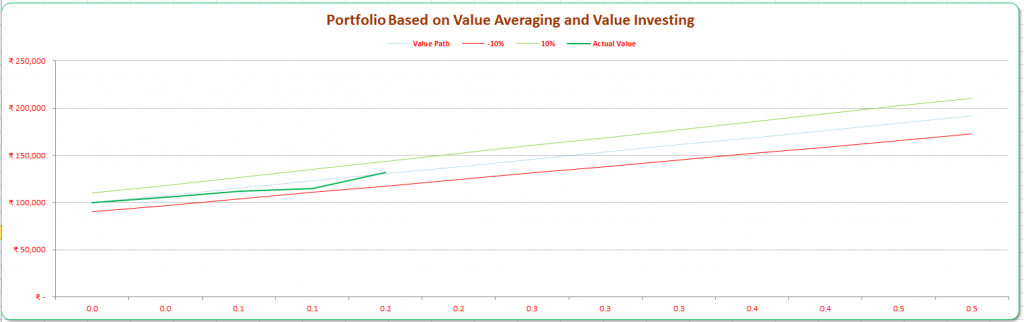

NIFTY has broken 8000 again. BJP has pretty much lost the Bihar election. Looks like the coming weeks will provide buying opportunities to long term investors. I may have jumped the gun and added TCS. I also nibbled at Amara Raja Batteries and Cadila Healthcare. The total investment now stands at INR 128,108 and the portfolio at 131,991, an annualized gain of 23%. According to the Value Path, the portfolio should be 130,556. The 10% range is 117,500 to 143,611.

Remember, we have to invest the amount required so that the value of the portfolio is as expected on the Value Path.

So, why did I buy more TCS? TCS seems to have a very good support at INR 2500. The stock hasn’t returned much over the last 18 months. I think this is a good level to buy. Amara Raja and Cadila has dropped significantly in the last few weeks. Although they may still go down, I think the current levels are reasonable to start nibbling. Two weeks back, I said banking should react, and it did. Bank of Baroda quarterly result was a howler. SBI wasn’t great either. I believe long term investors should identify the stocks they would like to buy, and be ready. The opportunities are just round the corner.

End November 2015 (22nd November 2015)

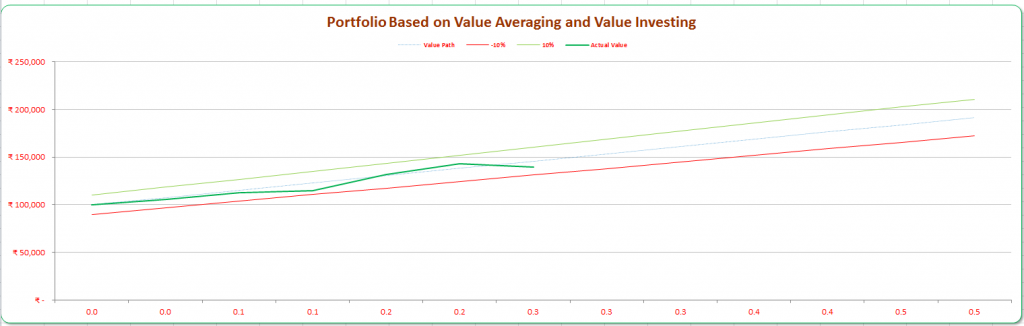

In my last update, I said, “Looks like the coming weeks will provide buying opportunities to long term investors”. NIFTY PE is at 21.7. I bought a few more TCS shares. The total investment now stands at INR 137,595 and the portfolio value at 142,851, an annualized gain of 12%. According to the Value Path, the portfolio should be 138,194. The 10% range is 124,375 to 152,014.

Remember, we have to invest the amount required so that the value of the portfolio is as expected on the Value Path.

Analysts have been busy downgrading quarterly earnings. NIFTY earnings has been downgraded about 10%, yet the NIFTY targets are still intact!

Another couple of quarters and the companies will surprise the downgraded estimates, and the market will go up again. I strongly believe long term investors will find great opportunities to buy quality stocks in the next 2 quarters.

More on this real life experiment

More on Value Averaging

Mid December 2015 (11th December 2015)

In the last update, I said,

A few weeks back, I said, “I strongly believe long term investors will find great opportunities to buy quality stocks in the next 2 quarters”. Markets the world over have gone down since. NIFTY PE has come down to 20.57. Oil is trading at less than $38. Gold is just about $1050 mark.

I made some trade in my trading account, but haven’t bought anything in this portfolio. If NIFTY corrects a bit more, I will continue to buy quality stocks. TCS has issued a profit warning due to the business losses caused by the flooding in Chennai. I believe, this is their way to be conservative in estimates.

The total investment now stands at INR 137,595 and the portfolio value at 139,465, an annualized gain of nothing. According to the Value Path, the portfolio should be 145,833. The 10% range is 131250,375 to 160,417. We are still within that range. PE of our holdings is as follows – TCS – 19.93, HDFC – 20.29, HDFC Bank – 25.73, Amara Raja – 31.48, Cadila Health – 28.75.

Remember, we have to invest the amount required so that the value of the portfolio is as expected on the Value Path.

End of January 2016 (29th Jan2016)

The last few weeks were highly volatile in the world market. However, we saw a rebound in quality stocks. My portfolio dipped a bit but recovered well. In the last few weeks, I bought some more HDFC and Cadila Healthcare. HDFC came up with a very decent quarter, yet again proving that they have the best asset quality. Their net Non-Performing-Asset is still under 1%. Compare this with the likes of ICICI Bank or Axis!

During the last few weeks, we saw the NIFTY PE dropping below 20 for a few sessions. It currently hovers at around 20.

Gold has inched up a bit, and Oil saw sub $30 levels. This is a great time for consumers of oil (like India). The total investment now stands at INR 166,532 and the portfolio value at 166.101, an annualized gain of nothing, compared to an annualized loss of over 7% in NIFTY. According to the Value Path, the portfolio should be 168,750. The 10% range is 185,625 to 151,875. We are still within that range. PE of our holdings is as follows – TCS – 18.96, HDFC – 19.36, HDFC Bank – 25.42, Amara Raja – 30.79, Cadila Health – 22.12.

The total investment now stands at INR 166,532 and the portfolio value at 166.101, an annualized gain of nothing, compared to an annualized loss of over 7% in NIFTY. According to the Value Path, the portfolio should be 168,750. The 10% range is 185,625 to 151,875. We are still within that range. PE of our holdings is as follows – TCS – 18.96, HDFC – 19.36, HDFC Bank – 25.42, Amara Raja – 30.79, Cadila Health – 22.12.

Remember, we have to invest the amount required so that the value of the portfolio is as expected on the Value Path.

Mid-March 2016 (11th March 2016)

The portfolio is now valued at INR 177,195 and has the same 5 holdings. We added a few more HDFC Bank shares in the last month. The portfolio is within our 10% tolerance range.

Participate in a real world practical experiment in stock investing and portfolio building using value averaging.

Here’s your personal invitation to come share the learning with me. I will share each activity that we do in this portolio, and also explain the rational behind my decisions.

All this for just Rs. 65 or USD 1.25 per week (less than a cup of coffee at Starbucks or Café Coffee Day).

Join now and start learning! Pay in INR | Pay in USD