Value Averaging Investment Plan – For Better Stock Returns

Value averaging investment plan (VIP) is similar to its more popular cousin, Dollar Cost Averaging that is so popularized by systematic investment plans (SIP).

Value averaging was first promulgated by former Harvard professor, Michael E. Edelson, in his book, Value Averaging, published by Wiley in 1988.

Conceptually, value averaging can be thought of as combining the attributes of both dollar cost averaging and portfolio rebalancing.

Value averaging starts with the end in mind. The investor decides the end goal and the time available to invest – say Rs. 10,00,000 in 10 years. Based on this a “value path” is created which tells the investor what the value of the portfolio should be at any given time.

Once the value path is created, investor makes sure that the actual portfolio value is as close as possible to the value path. If the portfolio value is “behind” the value path (there is a shortfall), the investor invests new money. If the portfolio is “ahead” of the value path, the investor sells the portion to bring it back to the expected value.

What this does in essence is, forces the investor to buy when the market is down and sell when the market is up.

According to Edelson, the simple version of this strategy is, “Instead of a “fixed dollar” rule as with dollar cost averaging (“buy $100 more stock each month”), the rule under value averaging is to make the value of your stock holdings go up by $100 (or some other amount) each month.”

For example, you want the portfolio to be worth $300 in 3 months, and you are starting with $0. Invest $100 at the beginning of the 1st month. Next month, the portfolio gains in value and is now worth $120. Since you want $200 in 2 months, you would now invest just $80 in the 2nd month so that the portfolio value becomes $200. Now in the 3rd month, if the portfolio is worth $195, you would invest $105 to make the portfolio worth $300.

As Edelson says, this is a simplistic way to understand the concept.

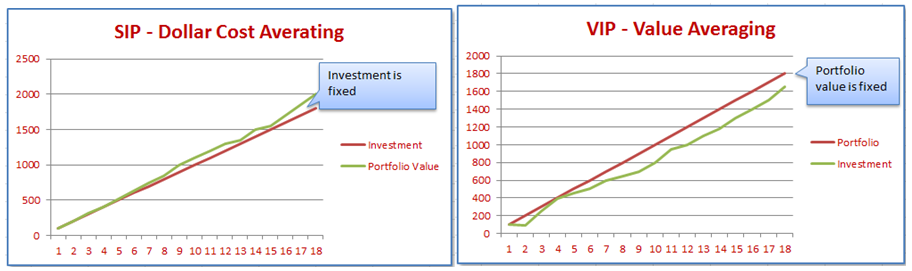

With SIP, the investment amount is fixed for every period. The value of the portfolio is higher than the investments made.

With VIP, the value of the portfolio is fixed. The cost of investments is usually lower than the value of the portfolio.

Buy Long Term NIFTY Performance Chart - Just Rs. 95! | Buy 3709 Companies Data - Just Rs. 485!

Advantages of Value Investing

- It forces the investor to start with the end goal in mind.

- It allows the investor to sell if the market has “run ahead of itself”.

- It is possible to adjust the end goal if need changes.

- It is possible to adopt the “no-sell” option where the investor decides not to sell, no matter what (like in an SIP).

- Inflation can be factored in while creating the value path.

- Stock market returned can be factored in while creating the value path.

There are some challenges when it comes to averaging, whether SIP or VIP –

- In our example, a $100 increase in the first few months is a lot, but over a long duration, say 10 years, an increase of $100 is negligible compared to the value of the portfolio. This means, the value add diminishes as you invest smaller and smaller amounts compared to the size of your portfolio.

- Doesn’t account for inflation adjustment. $100 invested in the 1st year is a lot more value than the $100 invested after 10 years.

- With VIP, since the amount to be invested will vary every month, it may be difficult to manage.

- There is just one fund (that I know of) offers VIP in India.

In 2000, Paul Marshall of Widener University published a paper titled “A STATISTICAL COMPARISON OF VALUE AVERAGING VS. DOLLAR COST AVERAGING AND RANDOM INVESTMENT TECHNIQUES”.

Paul concludes “Results strongly suggest, believe it or not, that value averaging does actually provide a performance advantage over dollar-cost averaging and random investment techniques, without incurring additional risk. The results are amazing and Dr. Edleson should be congratulated on seemingly important work in developing value averaging.”

I have started a new portfolio using Value Averaging. I share all the details about it along with weekly updates here. You can follow my portfolio and learn how to build your own. If you have any questions, just email me.

Buy Long Term NIFTY Performance Chart - Just Rs. 95! | Buy 3709 Companies Data - Just Rs. 485!