Share Market Basics for New Investors – Investing is not Gambling

‘Share market basics for new investors’ is a series of articles written to explain the basic fundamentals of the share market. In these articles, we will talk about the “street smart” knowledge investors need to be successful.

It is a general myth that share investing is like gambling. Most people come to this conclusion based on their following experience –

- Just like in gambling, people lose money in the stock market.

- Regardless of how much one analyzes the shares, there is significant information of companies that investors do not have. Hence investing feels like rolling the dice.

- Both involve risk and choice.

Yes, one can inherently turn stock investing into gambling by taking unnecessarily high risks, by following unproven ‘market tips’, and by over leveraging.

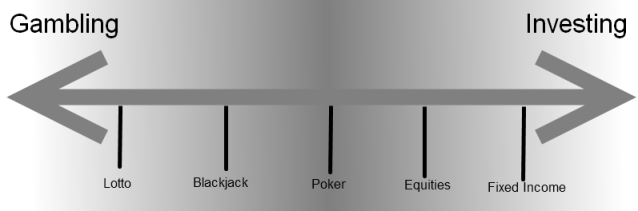

There are some similarities between investing and gambling –

- Taking risks in the hope of gaining an advantage.

- Betting against an uncertain outcome.

In investing, the odds are in your favor, where as in gambling the odds are against you. This is primarily because time is on your side.

“An investment is simply a gamble in which you’ve managed to tilt the odds in your favor.” – Peter Lynch

So why is investing not same as gambling? Here are some of the reasons.

- Gambling is time bound whereas investment can span over several years. The outcome of a bet placed in a casino is pretty much instantaneous.

- In gambling, it is very likely to lose the entire bet. In investing, one can control the amount at risk by setting a stop loss.

- If you shares lose value, you can still hold on to the shares. The value can increase in future.

- In gambling, the odds are in the favour of the house, whereas the odds are in favour of the investor. This is because, in the long run, the stock markets generally tend to go higher.

- Gambling is a zero-sum game. In other words money is transferred from losers to winners. There is no net gain. However, when you buy shares of a company, your money is put to use by the company that produces something. As the value of the company goes up (or down), so does the value of its shares.

- Investors are risk averse, whereas gamblers are risk takers. Gamblers go to a casino to convert Rs.100 into Rs. 1000. Investors seek a reasonable return.

The next time you hear someone say that stock investing is the same as gambling, remind them that in fact there are some similarities and some major differences. Both activities involve risk of capital with hopes of future profit. Gambling is typically a short-lived activity, while stock investing can last a lifetime. Some companies actually pay you money in the form of dividends to go along with an ownership stake.

Here’s additional reading from Baylor University and The Wall Street Journal.

Did you find this article in the series of Share Market Basics useful? Thoughts welcome!