PE or Price to Earnings Ratio is not as simple as it looks. Learn how you can use PE to your advantage

Understand how price to earnings ratio (PE) expansion and PE contraction impacts your stock price.

Most investors know PE stands for the price to earnings ratio and its formula is:

PE = Price / Earnings

Now, let’s ask the most fundamental question. Why do we invest in equities? The simple answer is, we expect the stock price to go up in future, thereby, giving us a return better than bank deposits and other assets.

Let’s go back to our good old formula – PE = Price / Earnings. Hence, Price = PE x Earnings.

This also means, the price will go up if –

- PE goes up and earnings stay the same or

- Earning go up and PE remains the same or

- Both, PE and earnings go up

So far, so good.

Now, let’s ask ourselves a few questions –

- Do you know your largest stock holding?

- Do you know the PE of your largest stock holding?

- Do you know the stock price of your largest stock holding?

If you are an engaged investor, you will know the answers to these questions, at least the ranges if not the exact numbers.

Buy Long Term NIFTY Performance Chart - Just Rs. 95! | Buy 3709 Companies Data - Just Rs. 485!

Now a few tougher questions –

- Do you remember the PE of your largest holding when you bought the first share?

- Do you know the PE trend of your largest stock over the last 5 years?

Very few investors can answer these questions, but if you replace PE with price in questions 4 and 5, most people will be able to explain.

What this shows is, most investors just focus on the price trend, but tend to ignore the PE trend and the earnings trend over the life of the investment.

It is very critical to understand the reason for the price movement – is the stock price increasing because of an increase in PE or is it because of the increase in Earnings or both.

During bull markets, the earnings may grow, but the increase in price is usually due to the increasing PE. This is known as PE expansion. During PE expansion, investors are willing to may more for the same unit earning.

During bear markets too, the earnings may grow, but the decrease in price is largely due to the contracting PE. This is known as PE contraction. During PE expansion, investors are willing to may less for the same unit earning.

Why this behavior?

The answer is simple, during bull markets, investors see a very rosy future, and hence see higher earning potential, and hence are willing to pay a premium today to enjoy the potential future gains.

The reverse is true for bear markets.

Rising PE tells us that the price growth is faster than the earnings growth.

For this analysis, it is important to look at historical PE ratios. Two good sites to get this information are IIFL and Equitymaster

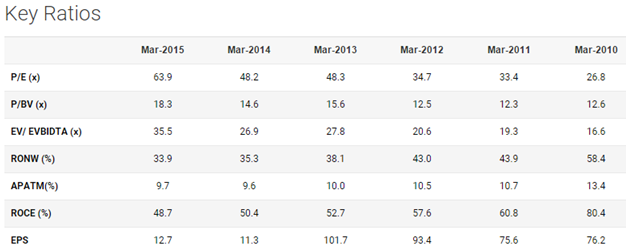

Both these links above use Asian Paint as an example. Asian Paints stock has tripled in 3 years. IIFL link shows that the PE has been steadily increasing over the last 5 years but the EPS has been reducing.

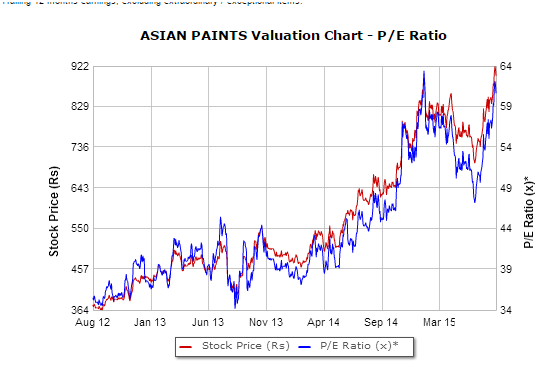

The EquityMaster website shows similar data in the form of graphs. The graph below shows that the stock has gone up from 350 levels to around 900 level during which period, the PE moved from 35 to 60.

So what is an investor to do? Here’s what most investors should do –

- Identify the top 5 holdings in the portfolio.

- Track not just the price but also the PE ratio and the earnings growth on quarterly basis, at least for the top 5 holdings.

- Review the historical PE and the earnings growth of the top 5 holdings.

- Watch for earnings related news on the top 5 holdings.

- If the earnings are not growing, treat that as a red flag and do additional research.

- If the price is increasing faster than earnings, consider booking partial profits.

Buy Long Term NIFTY Performance Chart - Just Rs. 95! | Buy 3709 Companies Data - Just Rs. 485!

Thanks for sharing such valuable information about pe ratios.