6 Reasons Why Warren Buffet is Wrong About Gold

Warren Buffett may be right about gold but it is out of context for a country like India.

We will discuss why Warren Buffett is wrong about gold investment, especially in a country like India. We will also see how Warren Buffett's Berkshire Hathaway compares to gild over a very long duration.

Warren Buffett didn't become the greatest investors of our generation by investing in gold. In fact, he pretty much hates the shiny metal. Buffett gave the following speech at Harvard in 1998 when he said of gold:

"(It) gets dug out of the ground in Africa or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head."

Buy Long Term NIFTY Performance Chart - Just Rs. 95! | Buy 3709 Companies Data - Just Rs. 485!

The primary reason Warren Buffett doesn't like gold is because it doesn't produce anything and it doesn't give dividends. These are very valid reasons to not consider gold as "investment grade". However, there are several reasons why one should buy gold, especially in a country like India where inflation is mostly in double digits.

1. Protection Against Inflation - Even Warren Buffett will agree that gold is a good way to hedge against inflation. In fact, gold is the best investment to hedge against inflation. For a country like America, where the inflation is less than 1-2%, it may not make sense to invest in gold. Indians have affinity to gold and real estate primarily because they retain their value over time. And let's not forget, the most important reason for us to invest our money is to protect against inflation!

2. High Liquidity - Gold protects against inflation and is highly liquid. Need we say more! Second criteria of investment is also met.

3. Measurable Value - Being highly liquid, gold's value can be easily measured. Hence it is very easy to track the change in valuation.

4. Can Be Used As Collateral - One need not sell gold if there is a need for cash. It is very easy to to get a loan against gold. Look at this another way. If you buy gold, and get a cash loan against it at a reasonable interest rate, your original investment is protected against inflation, and you have cash to meet short term needs. In this sense, indirectly, gold is being used to produce something from the money lent against it.

5. Central Banks Buy Gold - If world's central banks keep some of their reserves in gold, why shouldn't individual investors? After all central banks are professionals, and they know what they are doing, right? After all, we are talking about people like Ben Bernanke, and Raghuram Rajan. It is believed that China and Russia collectively bought over 2000 tonne of gold in the last year.

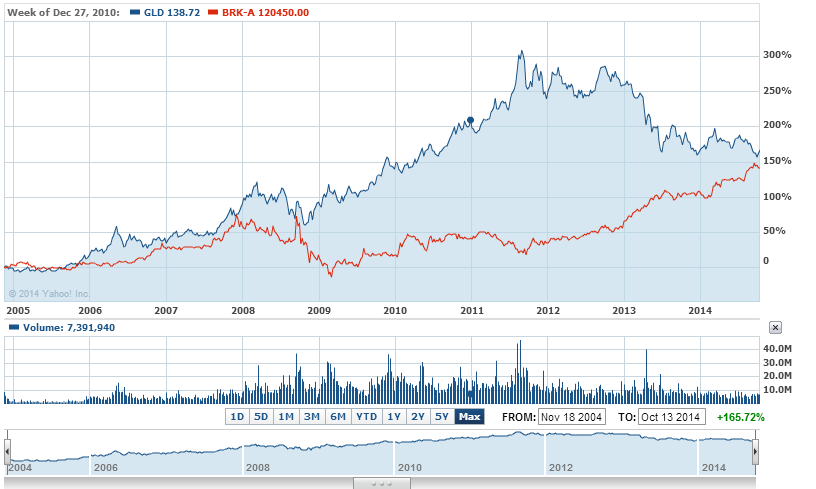

6. Berkshire Hathaway's Long Performance Similar to GLD's - This is the most important reason. GLD, world's largest gold ETF has given very similar results over a VERY long term. If you look at short term duration like 1 year or 5 years, Berkshire Hathaway has outperformed GLD in a big way, but over a long period of about 20 years, the results are very similar. So, if gold gives results similar to the world's best investor, how can it be called a bad investment?

The chart below compares BRK-A (Berkshire Hathaway) and gold etf over a large period of time.

In today's VUCA world (Harward Business Review), it makes a lot of sense to have some part of your investments in gold.

Buy Long Term NIFTY Performance Chart - Just Rs. 95! | Buy 3709 Companies Data - Just Rs. 485!

Hi Kunal,

Good one. I have another perspective of looking at gold as follows

Typically we Indians buy gold as jewellery and we have to pay significant amount of money in terms of making charges, weight of stones, loss etc both when buying and selling (may be 20% on both sides). Another factor is the quality of gold factor which is questionable (claimed vs actual). This dilutes the returns that investors get.

Another point is this is an investment that puts lot of burden on our forex and also is not a productive investment that aids in national growth.

Yes, agree completely. Gold for consumption and gold for investment should be kept separate as far as possible.

It does put a lot of stress on forex. Instead of the artificial clamp down that we currently have, government should focus on the root cause – try to reduce inflation for a prolonged periods of time.