2016 Stock Investing Strategy

If the first few weeks are any indicators, 2016 stock investing strategy is going to focus on bottoms up search for value stocks.

On March 23rd 2015, I wrote “The Bull Market is aging – here’s what you should do”. I suggested the following:

- US Dollar will be strong – invest in US focused companies, reduce exposure of commodities and avoid sectors like energy and material.

- Avoid value traps in EMs (India included).

On November 1st 2015, I wrote “Buy Gold this Diwali?”, I mentioned it was a good time to buy gold in INR (for the long term).

I was spot on, in both these cases.

Yet my Value Averaging portfolio is down 3.5% since its inception last year!

(Update: my portfolio has covered all the losses compared to the annualized return of -7% of NIFTY for the same period)

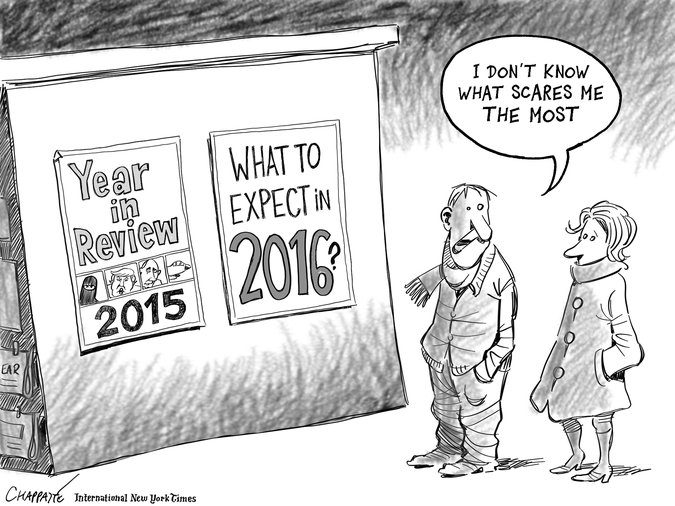

Such are the perils of forecasting!

So, what do we, the retail investors do in 2016? No expert predicted the rout in equities that we have experienced in the first 15 days of January.

Some experts blame it on the plunging oil prices. Granted oil was trading over $100 about 18 months back. However, it was around $35 last January. Surely $5 drop cannot be causing the stocks to fall so much.

Some experts blame the crash in China. Surely no one was taken by surprise that China has started slowing down. Experts like Jim Rickards (I am a big fan) have been warning us for years. The equity valuation had blown through the roof. A PE of around 100 had become the norm for the Chinese equity. As early as 2008, I had personally experienced that the Chinese were borrowing money to buy homes like there’s no tomorrow. People were afraid that if they don’t lock in the price NOW, they will not be able to afford a home tomorrow. Another clear sign that the bubble was fast building up. But most professional investors either turned a blind eye or hoped for a ‘soft landing’. Now it’s time to pay to piper.

Low commodity prices have had a huge negative impact on the commodity producers. Saudi Arabia has been looking at a fiscal deficit. However, it has a huge positive impact on the consumers of these commodities. India is one such beneficiary of the falling oil prices.

Before we look at where to invest in 2016, let’s look at some undercurrents that we expect to stay this year.

- US Dollar will continue to stay strong.

- China will continue to slow down.

- Oil and other commodities will continue to trade in the lower range.

- World GDP will grow at 2.5 to 3% this year. India and China will grow the fastest.

- Other BRICS countries will continue to face challenges.

- Inflation and deflation both will be a concern.

The biggest risk to international investors investing in India and China are their devaluing currencies. If the currencies devalue by 10% in 2016, the returns will automatically reduce for foreign investors.

In the US market, I would still recommend investing in those companies that will benefit from the growing economy. Focus on those companies that can grow without the need of additional borrowings. Companies like Corning, Starbucks, Tyler Technologies will do well. The key would be to buy them at a reasonable valuation. As much as I like Tyler, I think it is too expensive with a current PE of 79, forward PE of 45 and PEG of 3.5. However, they are in an exclusive business segment. With 34M outstanding shares, about 250M in cash, no debt, and an operating free cash flow of just about 90M, it is doing really well.

Good management is the number one criteria, more so in India, where promoters often have conflicting interests. Companies like Pidilite (makers of fevicol), TCS, HDFC and HDFC bank have proven that they are run by professionals that you can trust. The PEs of these companies have come be by a few points.

As a theme, I also like the pharma and medicare industries. Companies like Vinati organics, Ipca labs, Cadila healthcare, Torrent pharma deserves a closer look.

If the year turns out as difficult as the first 2 weeks, this will be a stock pickers’ year. Mutual funds will produce lower returns than their benchmarks, primarily because very few stocks will do well in such a market condition.

Instead of value investing, had I gone with the traditional SIP in mutual funds, for my new portfolio, I would have lost more than just 3.5%.

You can read all about my ‘Value Averaging’ portfolio here.

Sign up to receive a detailed weekly update on the portfolio.

SPECIAL OFFER: 30% discount on the regular price of Rs. 65/week (Rs.3380/year). Save Rs. 1014 with a one-time only 30% discount. It is completely risk free. You can cancel at any time.